Calculating 401k contribution from paycheck

But if you want to know the exact formula for calculating salary then please check out the Formula box above. The deferralcontributions limits are the total amount an employee can defer or contribute to a retirement plan.

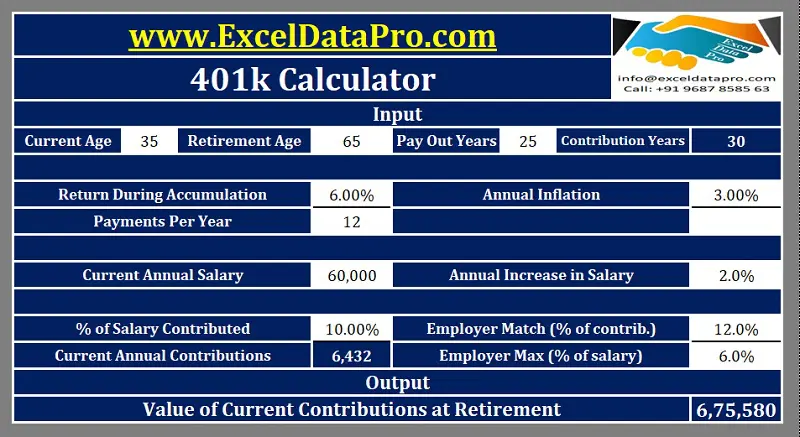

Free 401k Calculator For Excel Calculate Your 401k Savings

Employers can contribute to employee Roth 401ks through a match or elective.

. Refer to the employees Form W-4 and the IRS tax tables for that year to calculate and deduct federal income tax. All you have to input is the amount of sales tax you paid and the final price on your receipt. Enter your current IRA balance.

Tax On A 401k Withdrawal After 65 Varies. A self-employed 401k plan is a great way to save for retirement if you are an entrepreneur or solopreneur. Uæ QÜìõ POZm FÊÂùûo Áû ÂlÓåöxÿŸ¾êÿjª.

Free calculators for your every need. We automatically distribute your savings optimally among different retirement accounts. Inflation has exploded in the first half of 2022 all the way up to 91 in July so the 2023 contribution limits for many of these accounts will be increased.

Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future. Calculating payroll deductions is the process of converting gross pay to net pay. I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay.

In any qualified. The Paycheck Hit. That means individuals under the age of 50 can invest up to 20500 in 2022 plus an additional 6000 through.

How To Calculate Required Minimum Distribution For An Ira. Lets be honest - sometimes the best salary calculator is the one that is easy to use and doesnt require us to even know what the salary formula is in the first place. The contributions go into a 401k account with the employee often choosing the investments based on options provided under the plan.

Add a Free Salary Calculator Widget to Your Site. For 2021 the IRS says you can contribute up to 61000 in your self-employed 401k plan. Plus many employers provide matching contributions.

Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct. How you can forecast for your contributions affect on your retirement savings can be done through our online 401-K calculator. A percentage of the employees own contribution and a percentage of the employees salary.

Simply enter your information in the following fields. You dont have to worry about calculating the precise dollar or percentage amount to perfectly nail that 401K maximum on your last paycheck of the year or promptly cut off 401K contributions if you max out sooner. How much you need to contribute each month to maximize employer contribution for monthly retirement withdrawal goal.

On your Form 1040. Withholding Formula New York Effective 2022. Now you can find out with our Reverse Sales Tax Calculator Our Reverse Sales Tax Calculator accepts two inputs.

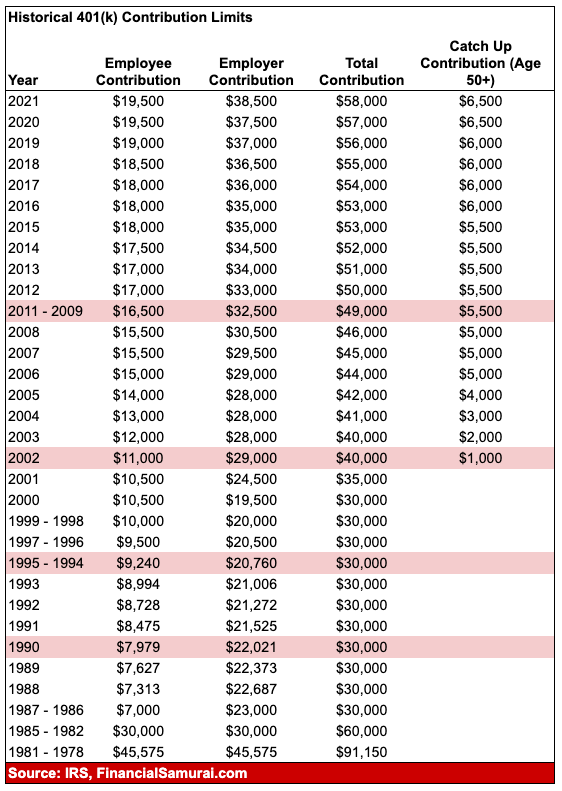

You only pay taxes on contributions and earnings when the money is withdrawn. Can I have company A treat my 2017 401K contribution like an over-contribution. Retirement contribution limits are adjusted each year for inflation.

Your 401k plan account might be your best tool for creating a secure retirement. Employee 401k contributions for plan year 2022 will rise by 1000 to 20500 with an additional 6500 catch-up contribution allowed for those turning age 50 or older. 401k Plan is a defined contribution plan where an employee can make contributions from his or her paycheck either before or after-tax depending on the options offered in the plan.

The limits for IRAs and 401ks are different. ÌþÀ IlRˆþœŸÖ3 1 Iór4íý õýëUæ-ÞÞvÕÈ. In fact if you know the latest inflation numbers it is possible to calculate the increase even before the IRS announces it in October or November.

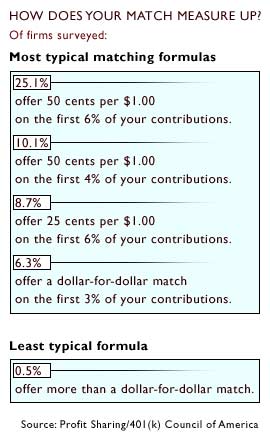

To calculate net pay subtract the total withholding for the pay period from the gross wages for the period. The closer you get to October the more accurate your projection can be. Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution.

Whatever you take out of your 401k account is taxable income just as a regular paycheck would be when you contributed to the 401k your contributions were pre-tax and so you are taxed on withdrawals. We assume that the contribution limits for your retirement accounts increase with inflation. Compensation is the maximum limit for calculating contributions.

As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll. We assume you will live to 95. Adjust gross pay by withholding pre-tax contributions to health insurance 401k retirement plans and other voluntary benefits.

We stop the analysis there regardless of your spouses age. Employers might match 25 50 or even 100 of an employees contribution up to a set percentage of the employees salary. Enter your income and location to estimate your tax burden.

Retirement plans - Most companies offer a 401k retirement plan that allows you to take pre-taxed wages and put them aside for your retirement. Enter your IRA contributions for 2021. This article will discuss how much you can contribute to your self-employed 401k plan.

Yes the contribution limits for 401k plans are separate from the limit for IRAs. Many companies match up to a certain percentage of an employees contribution to his or her personal 401k. Note that if you have any after-tax paycheck withholding health or dental insurance premiums etc you will need to add them to the Total Withholding before calculating your net pay.

Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages. Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator. Not all employers do but some will match up to 3 or more of the.

For the following plans the table is organized by tax year compensation deferralcontribution limits the catch-up limit and the overall contribution limit. The ultimate goal is to. For 2021 you can contribute up to 19500 up to 26000 if youre age 50 or older.

Enter your total 401k retirement contributions for 2021. A self-employed 401k plan is also know as a Solo 401k plan. Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes flexible spending account - health care and dependent care deductions from the amount computed in step 1.

But instead of integrating that into a general. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. An employer may offer a matching contribution for either a Roth or a traditional 401k.

Excel 401 K Value Estimation Youtube

Download 401k Calculator Excel Template Exceldatapro

Doing The Math On Your 401 K Match Sep 29 2000

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Solo 401k Contribution Limits And Types

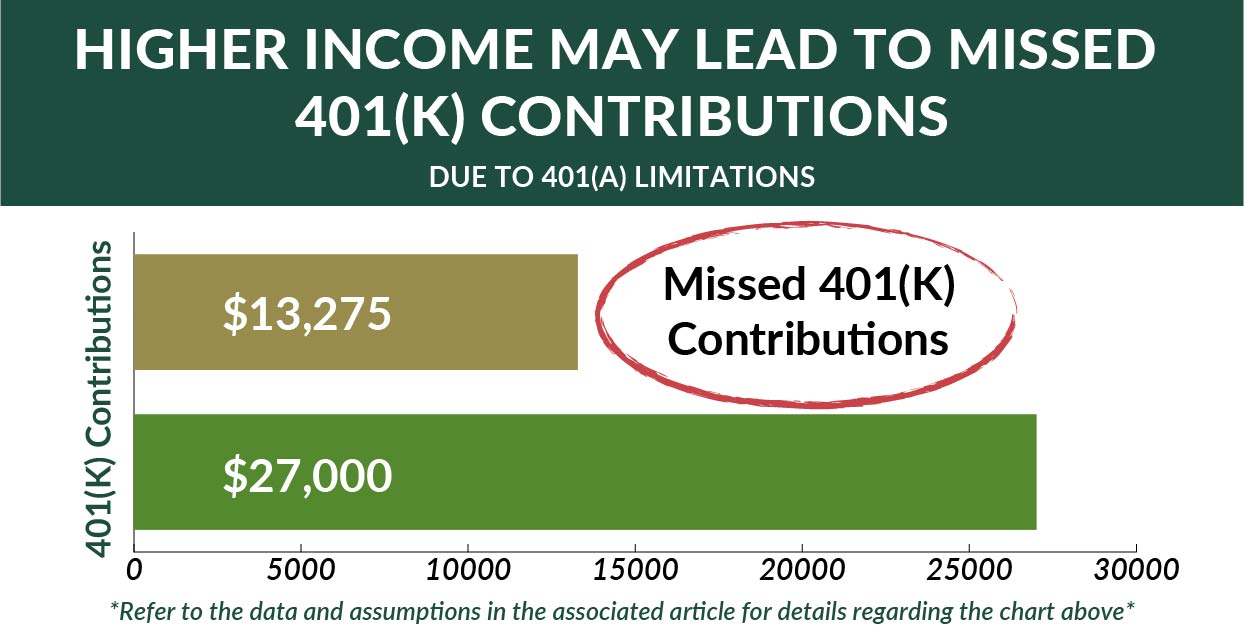

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

Doing The Math On Your 401 K Match Sep 29 2000

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

What Is A 401 K Match Onplane Financial Advisors

The Maximum 401 K Contribution Limit For 2021

401k Employee Contribution Calculator Soothsawyer

401 K Plan What Is A 401 K And How Does It Work

The Maximum 401k Contribution Limit Financial Samurai

401 K Maximum Employee Contribution Limit 2022 20 500

Download 401k Calculator Excel Template Exceldatapro

401k Employee Contribution Calculator Soothsawyer

401k Contribution Calculator Step By Step Guide With Examples